ESA vs. 529: Which Is Better for You?

8 Min Read | Jan 4, 2024

A college savings account is an incredible gift to give your children or grandchildren. It can help them graduate from college debt-free, which gives them a firm foundation to start building their life! So, whether Junior is 8 weeks old or 8 years old, open one as soon as you can and start setting money aside. The question is, where should you put that money?

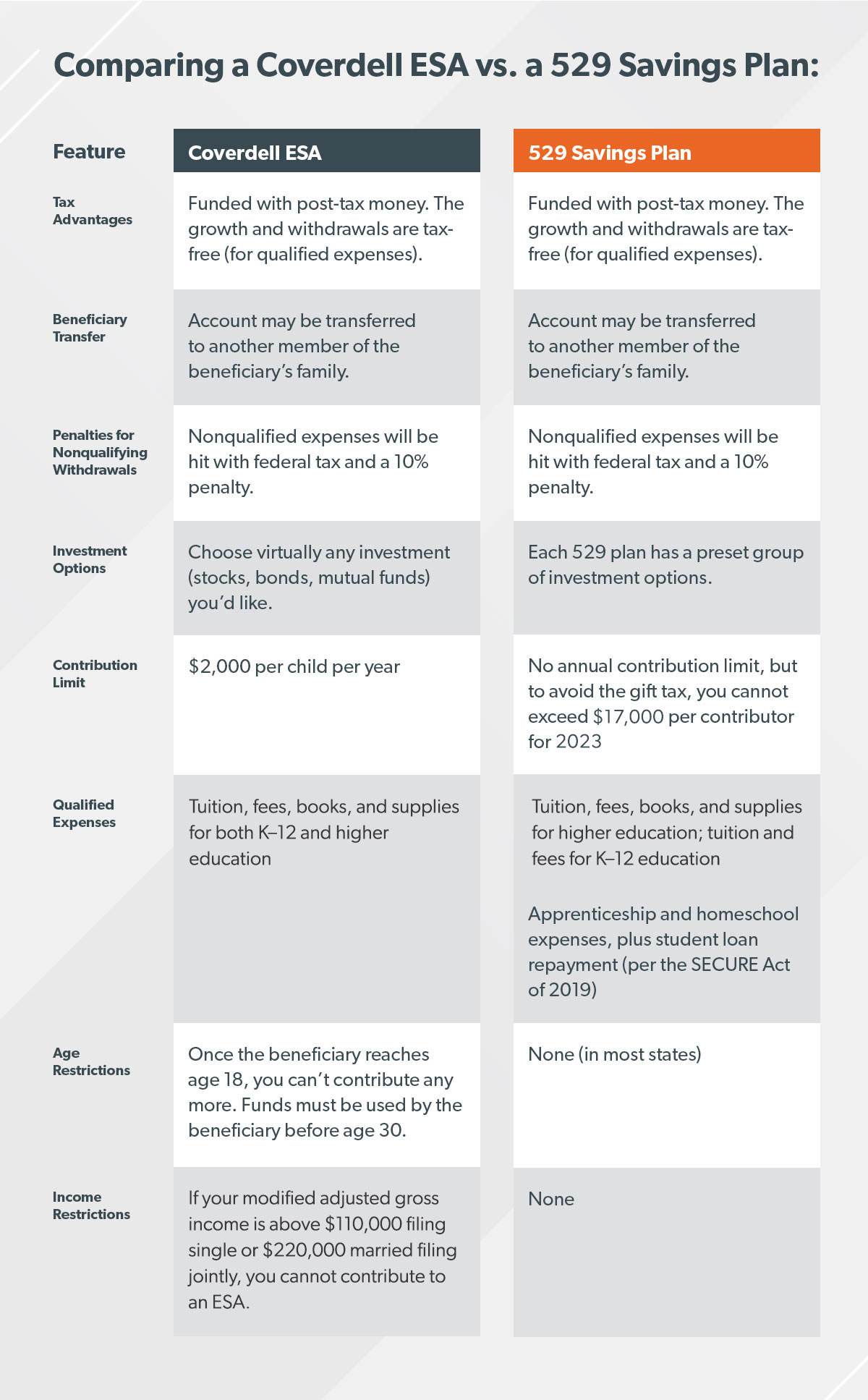

The account options vary depending on your income and your family’s needs, but in this article, we’ll compare the features of the two most common: the Education Savings Account (ESA) and a 529 plan.

But first, let’s make sure you understand the features of each plan!

What Is a 529 Plan?

A 529 plan (cleverly named after its section of the IRS code) is a state-run tax-advantaged account that allows you to set aside money for educational expenses. You can open a 529 plan for your child or grandchild and name them the beneficiary, which means that they get to use the money to pay for college, among other things. A 529 plan isn’t just a boring financial account—it’s an opportunity to change your family tree, people!

There are two basic types of 529 plans: savings plans and prepaid plans.

A prepaid plan locks in the current rate of tuition when your child or grandchild is born, allowing them to avoid the massive price increase due to inflation by the time they head off to college in 18 years.

The 529 savings plan allows you to choose a predetermined investing portfolio that you can use to grow money for your child’s future educational expenses. You can reallocate the money within the portfolio you choose, but only twice a year.

We’re going to focus on the savings plan in this article, because over the long haul, you’ll get a better return by investing your money instead of locking in a tuition rate with the prepaid plan. In addition, with most prepaid tuition plans, the state will only refund the principal (not any interest you’ve earned) if your child decides not to go to college. And you can’t transfer the money to a sibling of the beneficiary.

All right, let’s dive into the details of the 529 plan.

The Main Features of a 529 Savings Plan:

- It’s a tax-advantaged account that allows the beneficiary to use the money for both college and K-12 educational expenses.

- Each 529 plan varies from state to state.

- There are no annual contribution limits for a 529 plan, but you must pay federal “gift tax” if you contribute more than $17,000 in 2023 ($18,000 in 2024).1

- There’s no age limit for distributions (in most states). If your 32-year-old decides to go back to school, they can still use money from a 529.

- There are no income restrictions for contributing to a 529.

- Growth and withdrawals are not subject to federal income tax (used for qualified educational expenses, including tuition and books).

- If you want to use money in a 529 plan for noneducational expenses, you can. It’s your money! But nonqualified withdrawals are taxed and hit with a 10% penalty. The person who receives the distribution pays the tax on the money taken out.2

- The SECURE Act, passed in December 2019, created new qualified expenses for 529 savings plans. Distributions can now be used for apprenticeships, private K-12 tuition, and repayment of up to $10,000 of student loans for the beneficiary and their siblings.3

Of course, Uncle Sam loves fine print—so do your homework before you choose a plan!

Market chaos, inflation, your future—work with a pro to navigate this stuff.

Here’s a fun fact for you: You don’t have to use your state’s 529 plan. You can shop around and see if 529s from other states have better investment options and lower fees! Our best piece of shopping advice is to work with an investment pro who knows these plans better than anyone!

What Is a Coverdell Education Savings Account (ESA)?

A Coverdell ESA (named for the guy in Congress who pushed for it) is a trust or custodial account that allows you to save and grow your money for educational purposes. It’s very similar to a 529 plan, but with more restrictions and two major differences.

First, the contribution limit for an ESA is only $2,000 per child per year, while there’s virtually no limit to 529 plan contributions.4 And second, with an ESA, you can choose almost any kind of investment—stocks, bonds and mutual funds. Listen up: we like this feature of the ESA. We want you to have options, because having options gives you more control and flexibility for choosing the rate of return that you’ll need to hit your goals.

The Main Features of the ESA:

- Money must be used by the beneficiary by age 30 or given to another family member for educational purposes to avoid taxes and penalties.

- An ESA can be used for primary and secondary school, not just college expenses.

- An ESA has income restrictions. You can’t contribute to an ESA if you make more than $110,000 (single) or $220,000 (married filing jointly).5

- You can’t contribute more than $2,000 to an ESA per child, per year.

- Nonqualified withdrawals are taxed. The beneficiary pays the tax.6

Make an Investment Plan With a Pro

SmartVestor shows you up to five investing professionals in your area for free. No commitments, no hidden fees.

Ramsey Solutions is a paid, non-client promoter of participating pros.

How Are 529 Plans and ESAs Alike?

Let’s get clear about what ESAs and 529s have in common:

1. Both Are Investment Vehicles

Both 529s and ESAs allow your money to grow, not just sit in a cookie jar until little Suzie graduates and heads off to college. Like we covered earlier, the ESA has much more flexibility and variety in types of investments. But at the end of the day, both allow you to take advantage of compound growth so that you outpace inflation.

Here’s a quick story to show how powerful compound growth is. In theory, this scenario can apply to either account, but we’ll go with the ESA to keep it simple. Let’s say you open an ESA for little Suzie when she’s born. You max it out every year ($2,000) until she turns 18. By the time she graduates, you’ve put in a total of $36,000 of your own money.

But since you’ve been investing it, not just saving it, you’re going to end up with a lot more than that! Let’s say you earned an average of 8% compound interest over those 18 years. Little Suzie ends up with a total of $80,893 to pay for college!7 Boom!

2. Both Have Tax Advantages

Both ESAs and 529s are funded with money that’s already been taxed, just like a Roth IRA. As a result, the money grows tax-free and isn’t taxed when you take it out—as long as it is used for the approved educational expenses. If you use it for a nonqualified expense, you’ll get hit with federal taxes and a 10% penalty, no matter which program you chose. Uncle Sam wants to make sure this money goes toward school!

3. Both Can Be Transferred to Siblings of the Beneficiary

When you open a 529 or an ESA, you must name a beneficiary—the child for whom you’re saving the money. With both plans, you can transfer that money to someone who is related to the original beneficiary without paying taxes on the money. So, if you’re saving for your kids’ college, and they get full scholarships, you can give the money to another one of your children.

Which Is Better: An ESA or a 529 Plan?

Unless we sat down with you for a full coaching session, there’s no way we could tell you which plan is best for you. It depends on many factors—including your income, your family situation and where you think your child is headed in their career.

The easiest way for us to help you decide is to summarize their main similarities and differences so that you can make the right decision for yourself!

The Best Way to Hit Your College Savings Goal

No matter what you choose, you can’t go on autopilot. Never invest in anything you don’t understand. If you do your due diligence now, your children or grandchildren will have you to thank down the road for this truly incredible gift.

The best way to stay plugged into your investments is to talk with an investment professional—before you deposit a single penny! They’ll know the particular options in your state, including any tax breaks, and they’ll give you the clarity and confidence you’ll need by choosing the right plan.

Find an investment professional today!

Next Steps

- Meet with an investment professional to discuss your college savings options. Our SmartVestor program can help you connect with up to five investment pros in your area for free!

- Use our college savings calculator to find out how much money you’ll need for college and get a plan for how to make it happen.

- Learn more about some of the best ways you and your child can save on college costs, including applying for scholarships, choosing a more affordable school, and earning college credits while still in high school.

This article provides general guidelines about investing topics. Your situation may be unique. If you have questions, connect with a SmartVestor Pro. Ramsey Solutions is a paid, non-client promoter of participating Pros.