Winning with money

starts here.

starts here.

Answer a few questions about your life and money goals, and we’ll set you up with a plan that meets you where you are right now.

Share a little about yourself—like your life and money goals.

Dive into the results to see your step-by-step action plan.

Your money goals can be achieved, and we’ll guide you there.

Winning with money

starts here.

starts here.

Share a little about yourself—like your life and money goals.

Dive into the results to see your step-by-step action plan.

Your money goals can be achieved, and we'll guide you there.

The Money Plan. The Money Book. The Money Tool.

No matter where you are in your journey, you can be confident and ready to make the next right choice for your money with these great products.

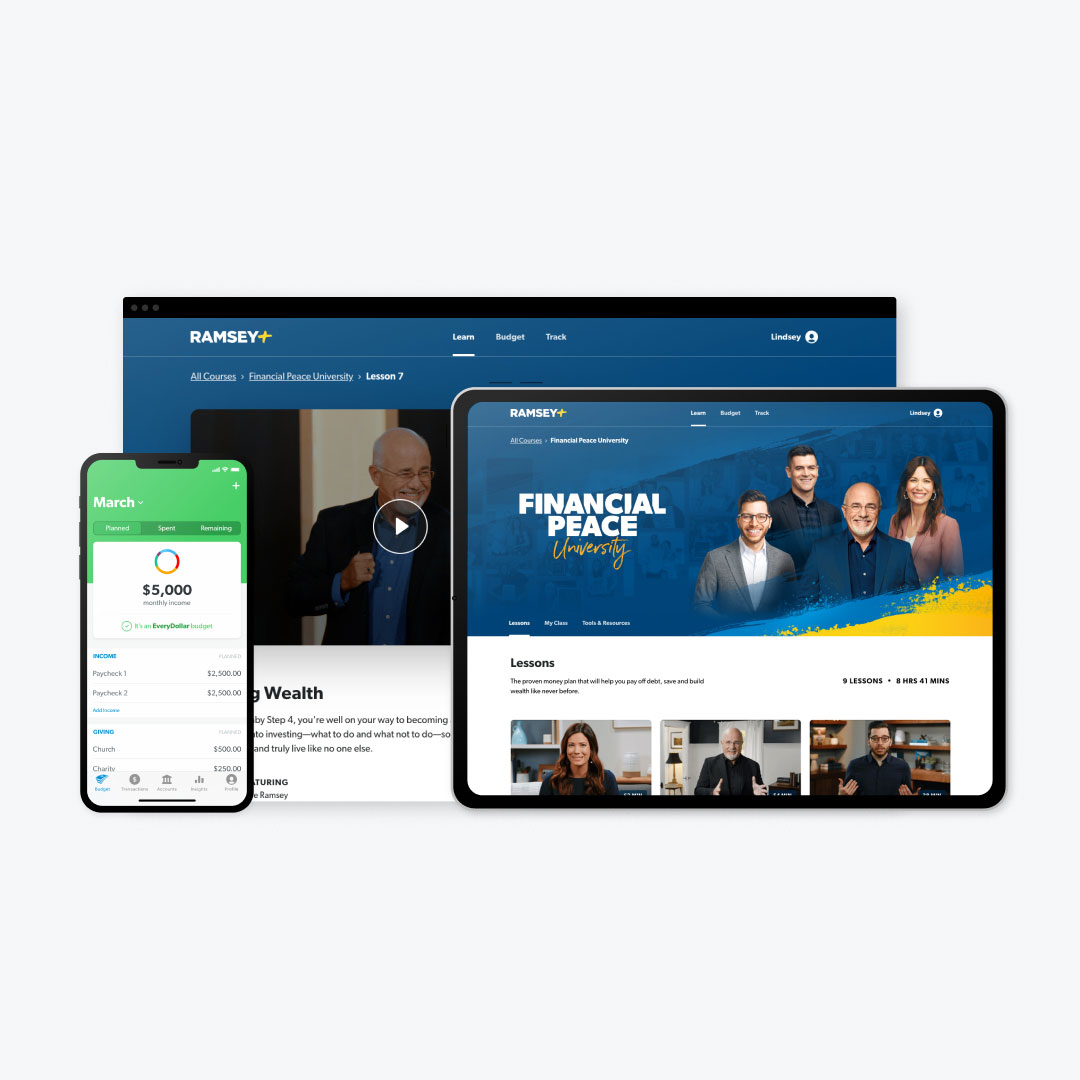

Financial Peace University

Learn the proven money plan to pay off debt, save for emergencies, and build wealth. Start a budget and take control of your money. Track your progress and crush your goals.

The Total Money Makeover

Dave Ramsey’s all-time bestselling book shows you how to walk the 7 Baby Steps and offers inspiring stories from many who’ve been right where you are.

EveryDollar

Find out where your money is going so you can make it work for you. Budgeting has never been easier with EveryDollar.

Who Is Dave Ramsey?

Dave Ramsey started Ramsey Solutions in 1992 to share what he’d learned after fighting back from bankruptcy. Dave is now known as America’s trusted voice on money and business. He’s a national radio personality with 16 million weekly listeners and seven bestselling books. Millions of people have ditched debt forever and turned their lives around by following his proven plan—the Baby Steps.

Who Is Dave Ramsey?

Dave Ramsey started Ramsey Solutions in 1992 to share what he’d learned after fighting back from bankruptcy. Dave is now known as America’s trusted voice on money and business. He’s a national radio personality with 16 million weekly listeners and seven bestselling books. Millions of people have ditched debt forever and turned their lives around by following his proven plan—the Baby Steps.