Meet EveryDollar: The Free Budget App That’s Just Right for You

8 Min Read | Dec 11, 2023

We can’t hide it. We love budgeting. Making a plan for your money (everything coming in and going out) is how you give your money purpose. It’s how you tell your money where to go so you’re not left wondering where it went. You. Take. Control.

This is so empowering!

But with so many ways to budget out there, how do you pick a method you’ll actually use? Insert EveryDollar.

What’s so great about EveryDollar? Glad you asked.

What Is the EveryDollar Budgeting App?

Personal finance expert and eight-time bestselling author Dave Ramsey started giving financial advice on the radio over 30 years ago. And today, The Ramsey Show has millions of weekly listeners.

But Ramsey Solutions also wanted to help people live out the show’s biggest piece of advice: make a zero-based budget and live by it—every single month. And that’s why we launched the free and premium versions our budgeting app, EveryDollar, in 2015.

EveryDollar Features Overview

EveryDollar offers a completely free version of the app with plenty of incredible features. And if you want to upgrade, there’s a premium version that’s $79.99 per year (with the option to start with a free trial).

Here’s a breakdown of some of the features in each version:

Free Budget Features

- Create monthly budgets

- Access your budget on your computer, phone or tablet

- Customize budget categories and lines for all your monthly expenses

- Create unlimited budget categories and lines

- Set up sinking funds and track savings goals

- Split transactions

- Set due dates for bills

- Talk to a live human being for customer support

Premium Budget Features

Includes all the free features, plus:

- Connect to multiple financial accounts in one app

- See custom budget reports

- Export transaction data

- Join live Q&A sessions with professional financial coaches

- Automatically stream your transactions into your budget

- Get tracking recommendations for your transactions

- Set due date reminders for your bills

- Calculate your current and projected net worth

- Plan your spending based on when you get paid and when things are due with paycheck planning

- Set big-picture goals and see a timeline of when you’ll hit them with financial roadmap

Comparison Chart of EveryDollar vs. Other Budgeting Apps

We know EveryDollar isn’t the only budgeting app out there. If you’re wondering how it stacks up, here’s a quick comparison chart of EveryDollar versus some of the others. (Plus, see how we compare to Mint, which was a top contender in the free budget app space but is closing its doors January 2024.)

|

Monarch |

EveryDollar |

||||

|

Availability |

Closes January 1, 2024 |

✔️ |

✔️ |

✔️ |

✔️ |

|

Free version option |

✔️ |

❌ |

❌ |

❌ |

✔️ |

|

Cost of paid version |

$59.88 per year |

$47.88 per year |

$99 per year |

$99.99 per year |

$79.99 per year |

|

Live group coaching sessions |

❌ |

❌ |

✔️ |

❌ |

✔️ |

|

Unlimited budget categories |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Secure bank connection |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Transactions automatically stream into your budget |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Goal setting and tracking |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Live customer support |

✔️ |

✔️ |

✔️ |

❌ |

✔️ |

|

Budget reports on spending and saving |

✔️ |

✔️ |

✔️ |

✔️ |

✔️ |

|

Zero-based budget focus |

❌ |

❌ |

✔️ |

❌ |

✔️ |

So, YNAB and EveryDollar are the only two zero-based budgeting apps up there—and it’s true, they both have similar features.

But YNAB says budgeters save an average of $600 in the first two months of using their product, while the average active EveryDollar user finds an extra $790 in the first two months.1

Plus, EveryDollar has a lower annual cost and offers a free version. Cha-ching times three.

What You Can Do With EveryDollar

Yes, we created EveryDollar. And yes, it’s our favorite. (Wouldn’t you be worried if it wasn’t?) One of the reasons we love EveryDollar is because of all the things you can do with it. Like what things? Like these things!

1. Create zero-based budgets.

With EveryDollar, you can create your first monthly budget in three quick steps:

- Enter all your income: Remember, this includes your regular paychecks, side hustles—everything coming in.

- Enter your expenses: Plan for all the giving, saving, spending—everything going out.

- Subtract your expenses from your income: This should equal zero (aka zero-based budgeting), which means you gave every single dollar a job!

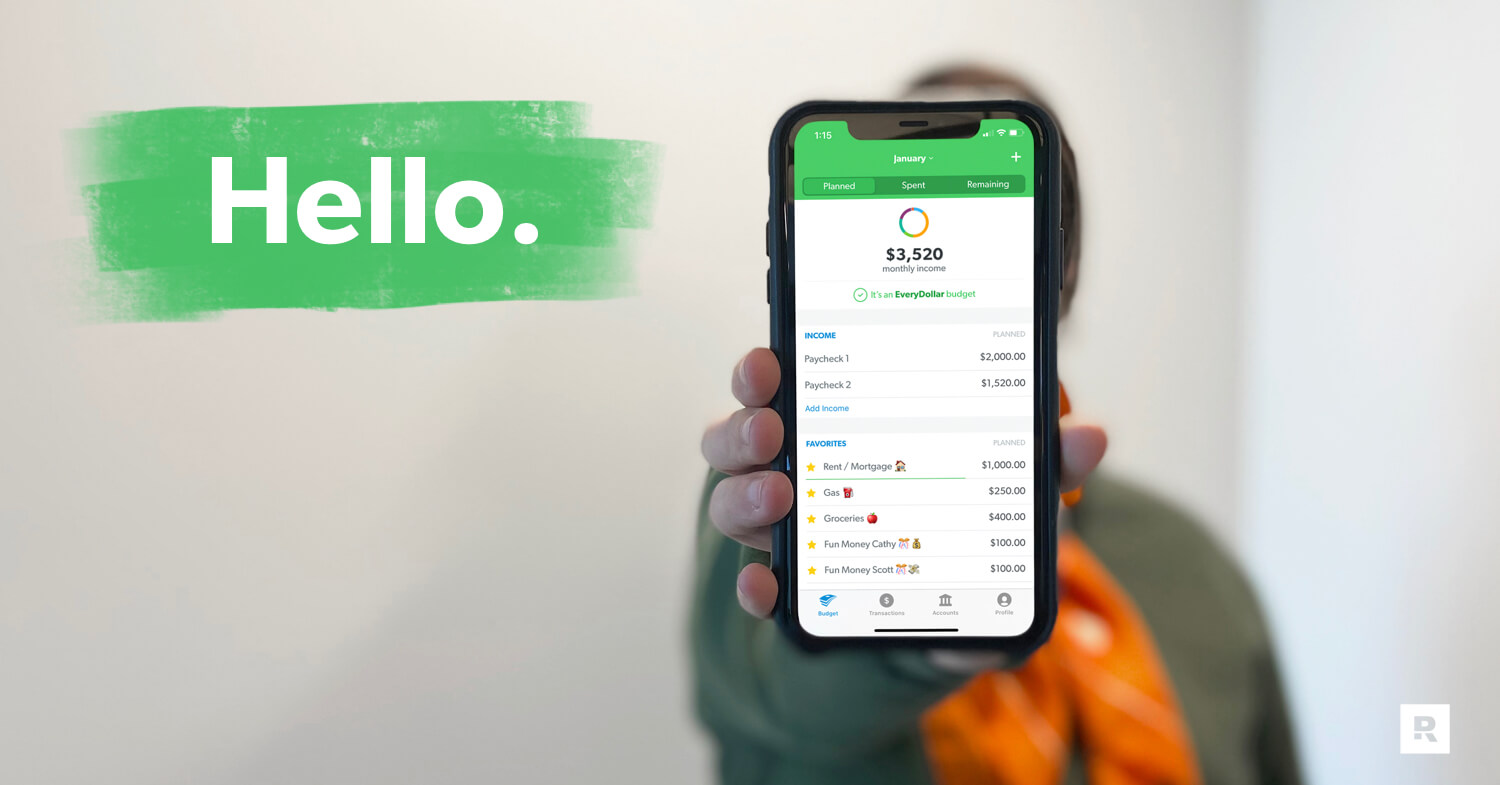

You’ll know you’ve budgeted to zero when you see a big green check mark and the words “It’s an EveryDollar budget” at the top of your screen. (Maybe one day we’ll have the technology to shoot live confetti out of your phone to celebrate. Until then, your vacuum is probably thankful.)

2. Customize your budget.

As you’re making your budget, make it custom! Name all those budget categories and lines whatever you want—and make as many as you want. This is your budget—it should reflect your spending. You can also add emojis for some visual flare. Who said budgets have to look boring? (No, really, who said that? We want to tell them about this feature.)

3. Track your spending.

Want to hear one of the biggest budgeting hacks? (Aka how to do this thing really, really well?) Track. Every. Expense.

Start budgeting with EveryDollar today!

In EveryDollar, you can add an expense to the correct budget line any time, anywhere. Enter it in your car before you ever leave the store parking lot. Or on your couch right after you pay that bill online. That way, you see what’s left to spend—and you don’t overspend!

And if you want to make it even easier, upgrade to the premium version of EveryDollar so you can connect your budget to your bank. Then those transactions will stream in automatically. You just drag and drop each one to the right budget line!

Either way, never skip this. Budgeting is how you plan. Tracking is how you keep up with the plan.

4. Add due dates to bills.

Say goodbye to the added financial stress of remembering when bills are due. Just tap on a bill in your budget and add a due date in seconds. The visual reminder will show up under that budget line every time you open EveryDollar so you won’t forget when to pay—or when that auto draft comes out.

5. Create funds to meet savings goals.

Sinking funds are a great way to save up for expenses that only come around once or twice a year (like car insurance or Sir Barksalot’s yearly checkup) and big purchases (like a new set of tires, a TV, or a trip to the beach). In EveryDollar, you can set up funds in a snap and watch your progress any time, any day.

6. Use on multiple devices (and share with your spouse).

Yep, you can use your EveryDollar budget on your phone, tablet or desktop (or all three). But it gets even better. If you’re married, you can both sign in to the same account so you can budget together, even when you’re apart. Talk about accountability!

7. Plan your budget around your paychecks.

Here’s another great premium feature: paycheck planning. What’s that? Well, if you have an irregular income—or you get paid more than once a month—this feature helps you set up your monthly budget based on paydays and due dates.

You won’t have to worry about running out of money before the next paycheck or getting hit with overdraft fees. The confidence it brings makes it one of our favorite reasons to upgrade.

8. Crush Dave’s Baby Steps even faster.

EveryDollar is the only budgeting tool created with the Baby Steps in mind (aka the proven plan for saving money, paying off debt, and building lasting wealth).

And listen, whether you’re on Baby Step 1 or 7, you need to budget. Budgeting is how you tell your money where to go. That means if you want your money to go toward ditching that debt, building your emergency fund, investing, saving up for a house . . . all those things—you budget for it!

So, budget with EveryDollar to crush the Baby Steps faster.

9. Show your money who’s in charge. (You.)

We love helping you, which is why we made EveryDollar. But EveryDollar is just a tool (an awesome tool, yes, but just a tool). You’re the one jumping in and budgeting to make real changes with your money—and your life.

We know it takes hard work to get this budgeting thing down. (It can take about three months of budgeting to really get the hang of it.) But we’re here for you—and we believe in you. You got this!

Download EveryDollar for free today and really show your money who’s in charge. (Psst. It’s you.)

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)