Types of Mortgage Loans: Which Is Right for You?

13 Min Read | Sep 18, 2023

It feels like there are a bazillion types of mortgage loans to choose from. That’s because mortgage programs keep inventing new ways to “help” people who aren’t financially ready to buy a house to buy one anyway.

But getting the wrong mortgage could cost you tens of thousands of dollars and decades of debt—not to mention a lifetime of money fights! We don’t want that for you.

That’s why at Ramsey we teach people about the different types of mortgages and their pros and cons so you can make a confident decision when buying a house.

What Are the Main Types of Mortgages?

Whether you get a mortgage through a broker, bank, credit union or direct lender, you’ll likely choose from at least one of these main types of mortgage loan categories:

1. Conventional Loans

2. Government Mortgages (Unconventional Loans)

3. Mortgages by Interest Rate Type

4. Other Types of Mortgage Loans

- Conforming loans

- Jumbo loans (non-conforming)

- Balloon mortgages

- Reverse mortgages

- Subprime mortgages

1. Conventional Loans

A conventional loan is the most common type of mortgage—making up more than 70% of all mortgages.1 This type of mortgage is a deal between you and a lender that meets underwriting guidelines set by Fannie Mae and Freddie Mac—government-sponsored enterprises that purchase mortgages from lenders.

Since conventional loans aren’t backed by the government, lenders typically charge a higher down payment (typically at least 5%) compared to unconventional government loans.

This type of loan also requires you to pay private mortgage insurance (PMI) if your down payment is less than 20% of the home’s value. PMI protects the lender (not you) if you stop making payments on your loan. That’s why we teach home buyers that the best down payment amount is 20% or more.

Get the right mortgage from a trusted lender.

Whether you’re buying or refinancing, you can trust Churchill Mortgage to help you choose the best mortgage with a locked-in rate.

Okay, now let’s cover the pros and cons of the two most popular conventional loans:

15-Year Fixed-Rate Mortgages

The 15-year fixed-rate mortgage is the best type of mortgage and the only one we at Ramsey ever recommend to home buyers because it has the lowest total cost compared to any other type of mortgage.

- Pros: A 15-year term keeps you on track to pay off the house fast, and usually has a lower interest rate and costs less total interest compared to longer term loans.

- Cons: A 15-year term comes with a higher monthly payment compared to a 30-year or longer term.

30-Year Fixed-Rate Mortgages

The 30-year fixed-rate mortgage is pretty much the same thing as the 15-year one except your repayment plan is twice as long.

- Pros: You’ll have lower monthly payments with a 30-year term, compared to a 15-year.

- Cons: You’ll have a higher interest rate, which means you’ll stay in debt longer and pay way more in interest than you would’ve with a 15-year term.

Bottom line: When you compare a 15-year vs. 30-year mortgage, the 15-year is always the smartest option because it saves you tens of thousands of dollars in interest and decades of debt! Choosing a 30-year mortgage only feeds into the idea that you should base major financial decisions on how much they’ll cost you per month—that’s flawed thinking. If you want to get ahead with your money, you’ve got to take the total cost into consideration.

2. Government Mortgages (Unconventional Loans)

Government mortgages are considered unconventional because they break away from Fannie Mae and Freddie Mac guidelines. They include government-insured programs (FHA, VA, USDA) that set their own underwriting guidelines.

Dave Ramsey recommends one mortgage company. This one!

If the loan meets these agencies’ guidelines, they agree to buy the house if the lender forecloses on the home, so the lender won’t lose money if you don’t make payments.

FHA Loans

The Federal Housing Administration designed the FHA loan to allow those who can’t qualify for a conventional mortgage to still be able to buy a house.

- Pros: Allows you to get a mortgage with as little as a 3.5% down payment.

- Cons: You’re required to pay a mortgage insurance premium (MIP)—a fee similar to PMI, except that you have to pay it for the life of the loan. The only way to remove MIP is if you have more than a 10% down payment—but even then, you’ll still have to pay it for a duration of 11 years!2 MIP can tack on an extra $100 a month per $100,000 borrowed. If you’ve borrowed $200,000, that’s an extra $200 on top of your regular mortgage payment each month. No thanks!

VA Loans

The U.S. Department of Veterans Affairs designed the VA loan as a “benefit” for military veterans to buy a house for as little as nothing down.

- Pros: Military veterans can buy a home with virtually no down payment or mortgage insurance fees like PMI.

- Cons: When you purchase a home with zero money down and things change in the housing market, you could end up owing more than the market value of your home. VA loans also come with a funding fee.

USDA/RHS Loans

The United States Department of Agriculture (USDA) offers a loan program, managed by the Rural Housing Service (RHS), to people who live in rural areas and show a financial need based on a low or modest income.

- Pros: With this loan, you can purchase a house with no down payment at below-market interest rates.

- Cons: USDA subsidized loans are designed to get people who really aren’t ready to buy a house into one. If that’s the only way you qualify, then you can’t afford a home right now.

Bottom line: Avoid the higher fees and hidden restrictions of government mortgages. Go with a conventional loan and pay a lower total cost.

If you can’t qualify for a 15-year fixed-rate conventional loan, put your house dreams on hold for now so you can focus on getting your financial life in order. (P.S. That all starts with a budget. Get the premium version of our EveryDollar budgeting tool, available only in Ramsey+, and make that happen.)

3. Mortgages by Interest Rate Type

Another factor that goes into the mortgage you choose is related to how the interest rate is treated. Here are two different options:

Fixed-Rate Mortgages

A fixed-rate mortgage means your interest rate stays the same for the entire time it takes you to pay off your loan.

- Pros: The size of your monthly payment stays the same, which makes it easier to plan your budget.

- Cons: Compared to a mortgage with an adjustable interest rate, a fixed interest rate might be higher—at first.

Adjustable-Rate Mortgages (ARM)

An adjustable-rate mortgage comes with an interest rate that goes up or down over the years—depending on market conditions. For example, if you get a 30-year mortgage with a 5/1 adjustable-rate, your interest rate will lock for five years, then adjust annually for the remaining 25 years.

- Pros: ARMs offer a lower interest rate (and monthly payment) for the first few years.

- Cons: Sure, the initial low interest rate is appealing, but in exchange for that lower rate up front, the risk of higher interest rates down the road is transferred from the lender to you. Many people find this type of mortgage appealing because they can qualify for a more expensive home. But, as many homeowners learned in the economic downturn, when your rate increases or you lose your job, the payment can quickly become too much for you to afford.

Bottom line: ARMs and variable-rate mortgages are among the worst types of mortgages out there. Keep more of your money and go with a fixed-rate mortgage instead.

4. Other Types of Mortgage Loans

Okay, we already covered the most common types of mortgages—but now let’s cover some other mortgage types and terms you should know about.

Conforming Loans

A conforming loan is a mortgage that meets guidelines set by the government and good ol’ Fannie and Freddie.

The main guideline is your loan amount. For 2021, conforming loans must be no more than $548,250 (there’s some wiggle room on that if you’re in a crazy market like New York City).3 Keep in mind that FHA, VA and USDA are not conforming loans.

Lenders like conforming loans because they can sell them to Fannie Mae, Freddie Mac, or other companies. That gets the loans off their books so they can fund more mortgages.

And you should like conforming loans too—they’ll keep you away from riskier loan options.

- Pros: With conforming loans, you’ll pay a lower interest rate compared to non-conforming loans.

- Cons: Conforming loans come with strict limits on how much money you can borrow.

Jumbo Loans (Non-Conforming)

If your loan size exceeds the limits of your specific mortgage program and doesn’t conform to their guidelines—as is the case with a jumbo loan—it’s considered a non-conforming loan.

- Pros: Jumbo loans exceed loan amount limits set by Fannie Mae and Freddie Mac, which means you can get a higher priced home.

- Cons: They require excellent credit and larger down payments, and they have higher interest rates than conforming loans.

Balloon Mortgages

Here’s how a balloon mortgage works: Let’s say you have a 30-year balloon mortgage. You might make monthly payments for several years. But then you agree to make one large, lump-sum payment to cover the total remaining balance at the end of your term.

- Pros: Balloon mortgages generally come with lower interest rates.

- Cons: If you’re not prepared, being on the hook for a massive payment due all at once could totally devastate your finances.

Reverse Mortgages

With most mortgages, you own more of your house over time. But there’s a type of mortgage that does the opposite—the reverse mortgage.

- Pros: With reverse mortgages, senior homeowners can supplement their limited income by borrowing against their home equity (the value of your home minus your current loan balance). They’ll receive tax-free, monthly payments or a lump sum from the lender.

- Cons: With this type of mortgage, you sell off your equity—the part you own—for cash. This puts your home at risk by adding more debt to your name later in life. With a traditional mortgage, the amount you borrowed and have to repay (principal) goes down over the life of the loan. But with a reverse mortgage, the amount you actually own goes down as your interest goes up.

Subprime Mortgages

The subprime mortgage was designed to bring the dream of homeownership within everyone’s reach—even for people who are struggling financially.

- Pros: The perceived pro is that lenders will give you money to buy a house, even if you have bad credit and no money. It was designed to help people who experience setbacks—like divorce, unemployment and medical emergencies—get a house.

- Cons: Lenders know there’s a big risk in lending money to people who have no money—go figure. So these mortgages come with crummy terms like high interest rates and stiff prepayment penalties.

Bottom line: A conforming conventional loan will be your lowest total cost option here, if you put 20% down to avoid PMI. Avoid all the other rip-off mortgages in this category.

Remember, the only mortgage we recommend is a conventional 15-year fixed-rate mortgage.

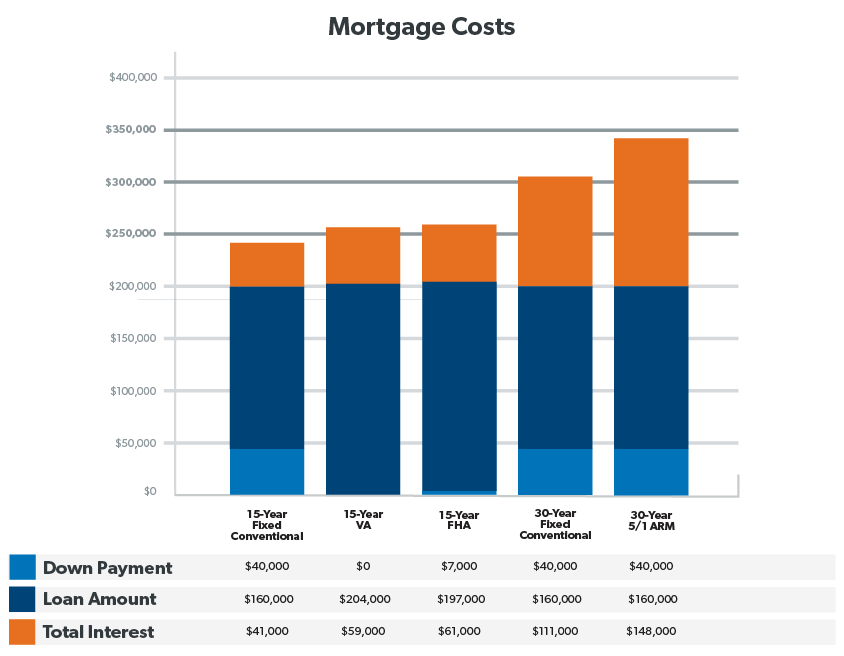

Mortgage Loan Comparisons

Okay, now let’s compare total interest costs between these common types of mortgage loans—you’ll see why the 15-year fixed-rate mortgage is the only way to go.

In each scenario, we’ve assumed a $200,000 home purchase at a typical interest rate for each mortgage option. For most of these examples, you can follow along using our mortgage calculator and mortgage payoff calculator. (For simplicity, we left out property tax, home insurance, PMI and HOA fees on each example.)

In each scenario, we’ve assumed a $200,000 home purchase at a typical interest rate for each mortgage option. For most of these examples, you can follow along using our mortgage calculator and mortgage payoff calculator. (For simplicity, we left out property tax, home insurance, PMI and HOA fees on each example.)

15-Year Fixed-Rate Conventional Loan

If you put 20% down ($40,000) on a 15-year fixed-rate mortgage at 3.125% interest, your monthly payment would be $1,115 and you’d pay nearly $41,000 in total interest.

That saves you anywhere from $18,000–107,000 in interest charges alone compared to the other mortgage options! Imagine what you could accomplish with that kind of money in your pocket!

|

Monthly Payment |

Total Cost |

|

$1,115 |

$241,000 |

15-Year VA Loan

Remember, the VA loan allows you to put zero money down. So let’s say you put no money down on a 15-year VA loan at 3.5% interest. For this example, we’ll assume your VA funding fee is $4,000 and you finance it into your loan because you don’t have any extra cash on hand—so you really borrow $204,000 total. That means your monthly payment would be about $1,460 and your total interest paid would come to nearly $59,000.

|

Monthly Payment |

Total Cost |

|

$1,460 |

$263,000 |

15-Year FHA Loan

Or suppose you went with a minimum down payment of just 3.5% ($7,000) on a 15-year FHA loan at 3.75% interest. With an FHA loan, you’d also have to pay nearly $4,000 in up-front MIP at closing (not to mention the monthly MIP fee, which we’ll leave out of this example).

Let’s say you finance that up-front MIP into your loan, which bumps up your loan amount to $197,000 and your monthly payment to more than $1,430. You’ll end up paying nearly $61,000 in interest over the life of the loan.

|

Monthly Payment |

Total Cost |

|

$1,430 |

$265,000 |

30-Year Fixed-Rate Conventional Loan

If you put 20% down ($40,000) and finance the rest with a 30-year fixed-rate conventional mortgage at 3.875% interest, you’ll pay $752 a month in principal and interest. Your total interest paid on your $160,000 loan would come to nearly $111,000 by the time your mortgage is done.

|

Monthly Payment |

Total Cost |

|

$752 |

$311,000 |

30-Year Adjustable-Rate Mortgage

Let’s say you buy the $200,000 house with a down payment of 20% ($40,000) and you finance the remaining $160,000 with a 5/1 adjustable-rate mortgage at an initial interest rate of 3.25%. (FYI: ARMs usually have 30-year terms.)

Using an ARM calculator, you’d start out paying $696 a month for principal and interest. After the first five years, we’ll say the rate bumps up by just a quarter percent each year. By the last year, your payment is up to $990, and you’d pay nearly $148,000 in interest over the life of the loan.

|

Monthly Payment |

Total Cost |

|

$696–990 |

$348,000 |

Bottom Line: 15-Year Fixed-Rate Conventional Loan Saves the Most Money

If we stack these five mortgage options against each other, it’s easy to see where the costs add up. For instance, the 30-year 5/1 ARM charges the most interest of the bunch, while the 15-year FHA packs the highest fees. But the 15-year fixed-rate conventional mortgage with a 20% down payment always saves you the most money in the end!

Work With a RamseyTrusted Mortgage Lender

Now that you know the types of mortgages, avoid the ones that’ll cripple your financial dreams! To get the right home loan, work with our friends at Churchill Mortgage. They’re full of RamseyTrusted mortgage specialists who actually believe in helping you achieve debt-free homeownership.