Downsizing Your Home: 3 Money Benefits

6 Min Read | Sep 5, 2023

Some people think moving up in life means buying a bigger home—well, it’s time to set the record straight. Most American families have plenty of room to downsize their home without cramping their style.

Consider the numbers: The average new single-family home comes in at nearly 2,500 square feet.1 You may not think that’s all too big until you look back at history. The average home size in 1975 was almost 1,000 square feet less than homes built today—and families were bigger back then.2,3 By those standards, today’s homeowners are living large!

Moving into a smaller home may feel like a step down, but a closer look reveals quite a few upsides: saving money, saving time and having less clutter in your life. Downsizing could be just the fresh start you and your family need!

How to Downsize Your Home the Right Way

Smaller mortgage payments and spending less time dusting those spare rooms may sound like a dream come true, but is downsizing really the right move for you? Before you head down the path toward downsizing, here are some tips to make sure your downsizing dream doesn’t become a costly mistake.

1. Think Long-Term

If you’re thinking about downsizing your house, planning ahead will set you up for success. Do you need extra space for that freelance business you’re planning to start? Or were you left with more than enough room to spare after the kids headed off to college? Only you know if you can spare that extra space or if losing it would be more of a headache than it’s worth.

2. Keep It Functional

Remember back in college when your entire life fit in that tiny dorm room? Somehow you had everything you needed within arm’s length. Though that may be far from practical these days, you can still benefit from cleaning out the clutter from those closets.

Sell what you don’t need and take that money to the bank, baby! Or donate it to a local charity and get the added bonus of a tax benefit. Wouldn’t it be nice to have less to clean and more money in your pocket?

Think of all the fun you could have if you didn’t have to polish your miniature unicorn collection every weekend. You just might find a whole new world outside your door!

3. Consider Hidden Costs

Downsizing may save you money in those monthly mortgage payments, but what about the hidden costs? Does your home need any repairs to get it market-ready? What about your old furniture and appliances—will they fit into the smaller place, or do you need to bump up that budget for more space-efficient pieces?

And don’t forget to take into account the cost of moving, property taxes, storage or even higher HOA fees. When it comes down to decision time, you may find that taking that leap to a smaller space will save you big time—or that you can save just by staying right where you are.

4. Focus on the Big Picture

Downsizing your square footage might mean your family has to gather around one TV at night instead of spreading out across three or four different rooms (Gasp!). But is more time with the ones you love really all that bad? It just might be the kick in the pants you need to spend quality time together.

With the right agent, taking on the housing market can be easy.

Buy or sell your home with an agent the Ramsey team trusts.

Financial Benefits of Downsizing

Still not convinced? Then it’s time to bring out the big guns and talk money. What if you reduced your mortgage by $500 a month and put that cash toward other financial goals? Check out three strides you could make:

1. Attack Your Debt Snowball

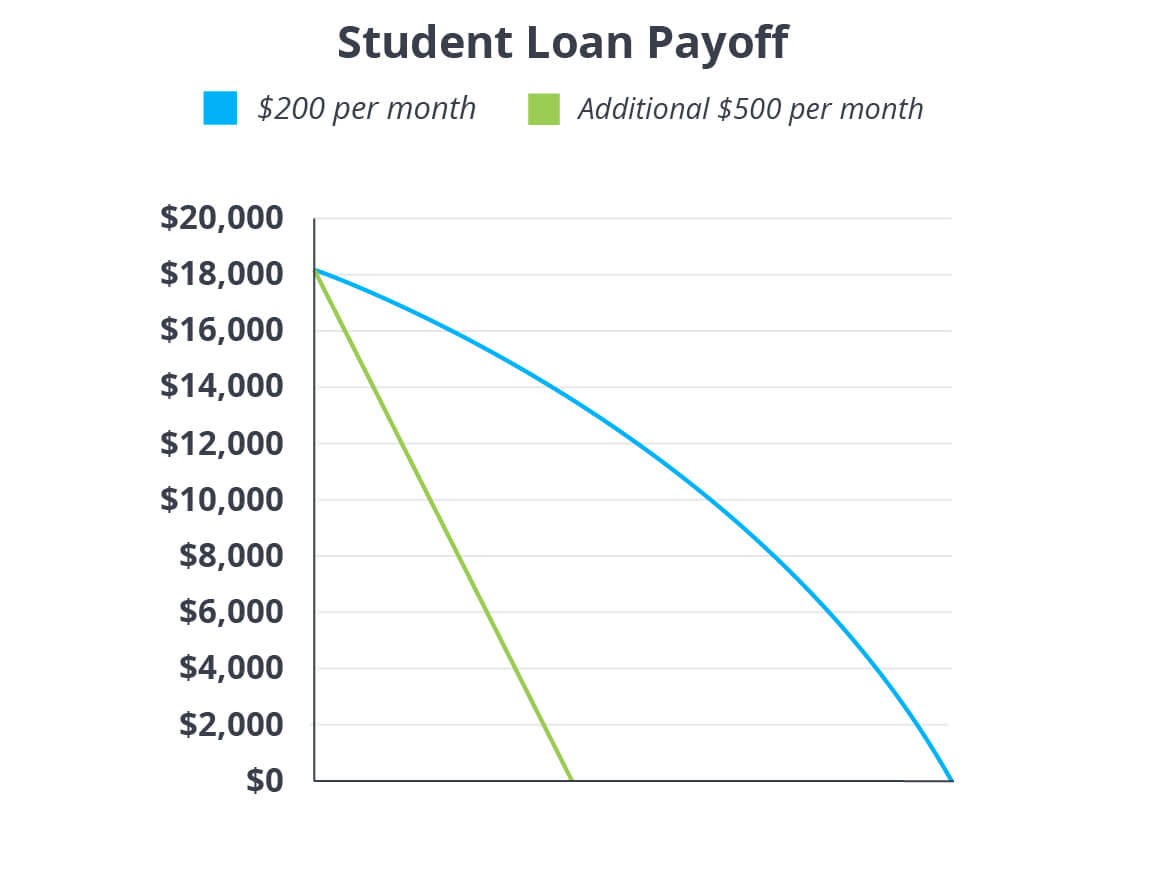

If you’re working hard to kick debt to the curb, downsizing your home is a huge way to crank up your intensity. Let’s say you owe $18,000 on your student loan. With a 6% interest rate and a minimum payment of $200 a month, you’ll be paying on that loan for 10 more years!

Find expert agents to help you sell your home.

But throw an additional $500 at your loan each month, and you’d trim a whopping seven-plus years off your payoff date. Sallie Mae will have to find a new place to live, because you’ll be free from student debt in less than two-and-a-half years!

2. Boost Your Retirement Fund

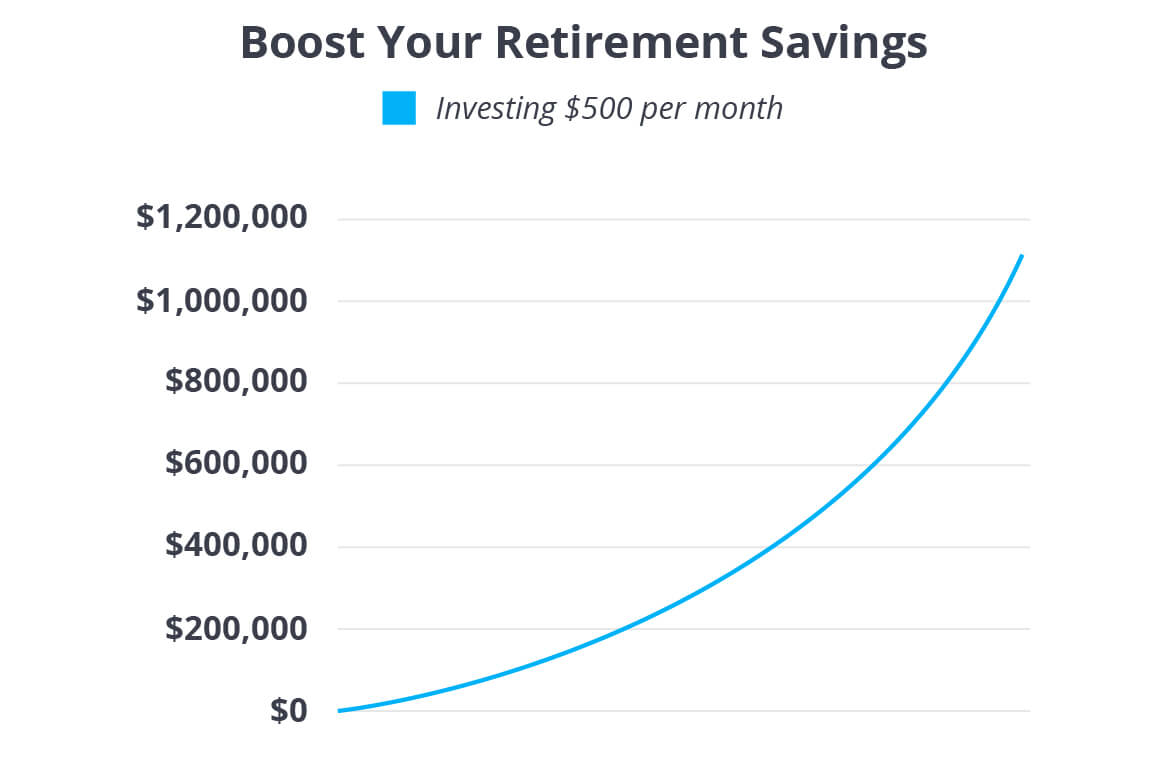

Once you’re debt-free with a fully funded emergency fund, it’s time to build wealth for the future. We recommend investing 15% of your household income into Roth IRAs and pretax retirement plans. If you’re still working your way up to 15%, that extra $500 could be the push you need to get there. And, boy, the difference $500 could make!

In 30 years, you could have an additional $1.1–1.7 million in the bank to get you through your golden years. You can do a lot of living and giving with that nest egg!

3. Pay Off Your Mortgage

Okay, here’s one more smart way to use the extra money you get from downsizing your home: Trade in your mortgage for a paid-off home! Use the proceeds from selling your current home to pay cash for a smaller one. Just imagine what you could do with no mortgage holding you down!

If you can’t pay cash, aim for a 15-year fixed-rate mortgage and put at least 10–20% down on your new home. Apply the $500 you saved from downsizing to your new monthly payment. At 4.5% interest, you could pay off a $200,000 mortgage in less than 10.5 years, saving more than $25,000 in the process. Cha-ching!

Use our full mortgage payoff calculator to see how quickly you can pay off your house!

Ready to Downsize? We’ll Show You Where to Start.

Downsizing might not make sense in every situation, but it’s worth a look if you really like the idea of saving money and simplifying your life. Ask an experienced real estate agent to help you determine what your home is worth and show you options for cutting costs.

For a quick and easy way to find one of the top agents in your area, try our Endorsed Local Providers (ELP) program. The pros we recommend know what it takes to get top dollar for your current home and negotiate the best deal on a new one.