How to Determine Budget Percentages

13 Min Read | Jan 3, 2024

If you’ve never budgeted before—or you’re wondering how your spending compares with everyone else’s—you might wish you could see some recommended budget percentages, national spending averages, and other helpful stuff like that all in one place.

Hey! This is that place!

And listen, I’m not about to give you a one-size-fits-all budget percentage guide. Because your life isn’t one size fits all! How much you should spend on this and that in your budget can vary depending on your income, household, location, goals, lifestyle—so many things.

But there are a few standards to follow. So, I’ve pulled them together with other helpful info to guide you as you’re setting up (or fixing up) your budget! Are you ready for this?

Here. We. Go.

Guidelines for Setting Your Budget Percentages

Let’s break down some national averages and budget percentage recommendations for common budget categories and budget lines.

If those words are new to you, think of a budget category as a folder, and the budget lines as files inside it. Or maybe a category is like a playlist, and the lines are like songs.

Also, if you’re reading this as you set up your first budget, don’t stop with the numbers I’m about to give you. Look up your own! Open your online bank account or get out those bank statements and see what your past spending reveals.

So, before we dive in, here’s an overview of the budget categories we’ll cover in this article:

Giving

Saving

Food

Utilities

Housing

Transportation

Health

Insurance

Childcare

Lifestyle or Entertainment

Personal Spending

Miscellaneous

Debt

Giving

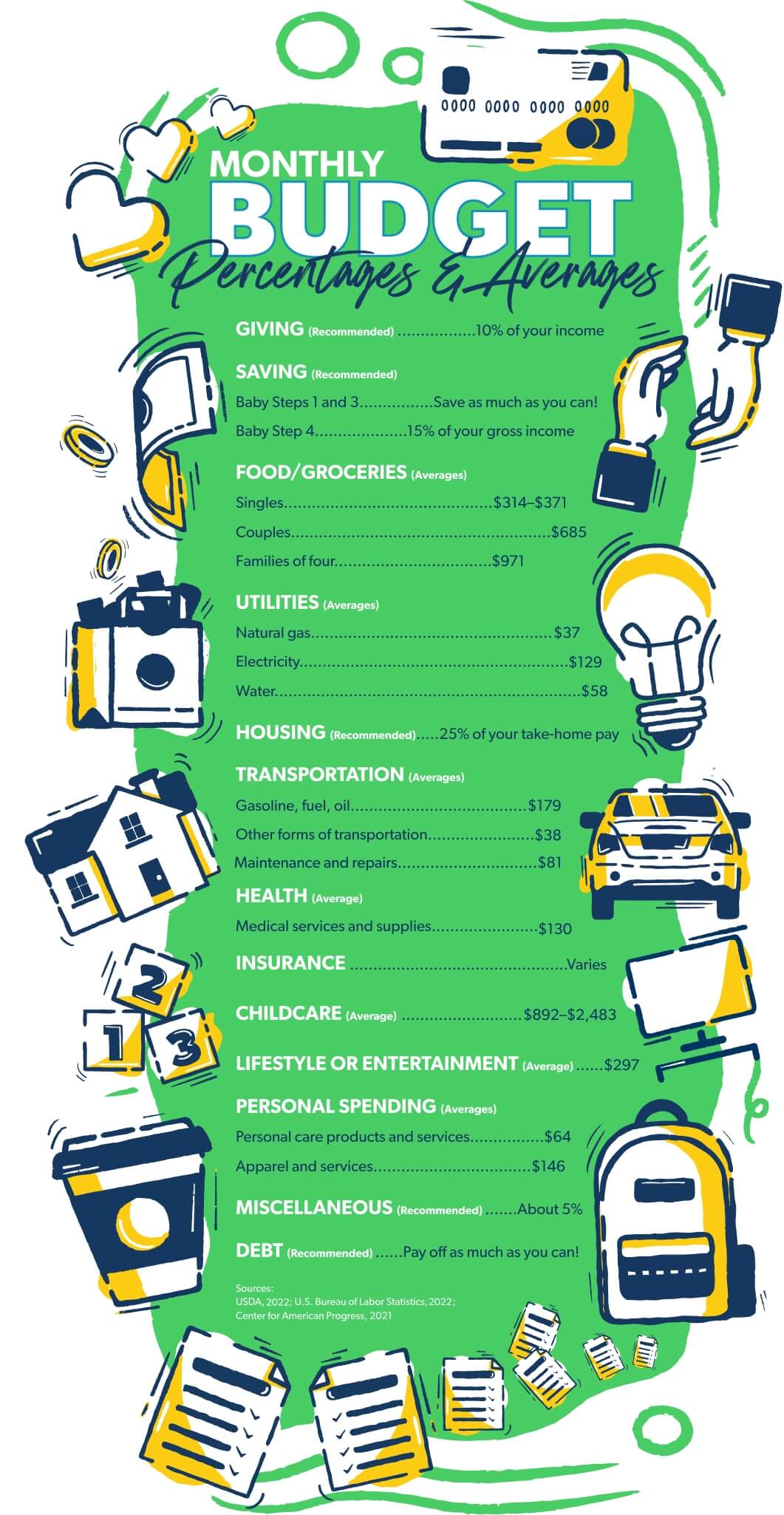

I believe in giving. Always. Tithing to your church, donating to charities, supporting worthy causes—even if you’re in debt. Generosity shifts the focus off of us (our problems, our financial stress) and reminds us of our blessings. And it’s one of the best ways to find true contentment with what we already have. Giving is good for you and for others, and I will always recommend giving 10% of your income.

Saving

Heads up: I’m about to talk about the 7 Baby Steps. A lot. This is the proven, guided path to save money, pay off debt, and build wealth. (Aka how to win with money.) The Baby Steps tie in with how much you should spend in a few of these budget categories—especially savings.

If you’re wondering what’s typical here, the average American saves around 9% of their income.1 But this is a great example of how a percentage or even an average shouldn’t set a standard for you. How much you’re putting in savings each month depends on several things!

When it comes to the savings category of your budget, think about these three reasons to save: emergencies, big purchases and wealth building. Since budget percentages for these can vary, let’s talk through each one.

Emergencies: Set aside $1,000 in the bank right away. (I call that a starter emergency fund, or Baby Step 1.) This puts a cash buffer between you and those life happens moments. If you’ve got debt (which I’ll cover later) keep that emergency fund at $1,000 until you’re debt-free (which is Baby Step 2).

When the debt’s gone, you need to save up a fully-funded emergency fund (Baby Step 3). This is 3–6 months of expenses and will protect you against bigger emergencies, like job loss.

The thing is, there isn’t a set percentage of your income you should put toward your emergency fund each month. Basically, if you don’t have one yet, you need to cut back on any extras—so you can get intentional and intense about building your savings—until your emergency fund is full.

Start budgeting with EveryDollar today!

Big Purchases: Another reason to put money in savings is so you can pay cash for big purchases. This includes saving up for a reliable car to replace the one you know is on its last legs (or . . . last tires?).

The key word here is know. When your car breaks down, to your complete surprise, that’s a job for the emergency fund. But when you know your 30-year-old Jeep is hanging on by duct tape and prayer, that’s when you start saving for a replacement.

Home repairs work the same way, really. Some are surprises. Some aren’t. Keep your eyes on your stuff so you’ll know when to put money in savings for those necessary big purchases.

And what about the fun big purchases—like Disney vacations or new furniture? You should save up cash for these too! But hear me clearly on this: Get to the luxuries after you’re debt-free and have real financial security. (Disney can wait!)

Again, there isn’t a set percentage here. Just remember—the more money you throw at a goal, the quicker you get there!

Wealth Building: The last reason to save up money is for wealth building. Once you’ve paid off your debt and are sitting on top of that fully funded emergency fund, it’s time to start saving for the future!

This time, I do have a solid percent for you: At this stage of the game, you should be investing 15% of your gross income for retirement savings.

Pro tip: Learn more about walking the 7 Baby Steps.

Food

When we’re not making or eating food, we’re thinking about food, right? (Well, I know I am.) It’s no wonder this budget line is one of the hardest to keep on track.

While I don’t have a set percent here, I can give you some national averages of what Americans spend on groceries each month in the “moderate” spending range:2

- Singles age 19–50 spend $314 to $371.

- Couples age 19–50 spend around $685.

- Families of four spend around $971 (for the “thrifty” plan).

What about restaurant spending? (I mean, I love eating out or bringing pizza home to my family.) Well, the average household spends $3,030 a year in this budget line. That’s around $252.50 a month if you divide it equally.3

Here’s a quick callout: As you start budgeting, these numbers can help. Of course, the size of your family, any dietary restrictions, and your lifestyle will all affect your spending here.

As you budget from month to month, pay attention to what you plan versus what you actually spend. Are you over budget? Like . . . often? Why? It could be that your expectations are unreasonable—or your spending is! Both can be fixed. You’ll just need to work at it. It’ll get easier every month. Seriously! You’ve got this.

Pro tip: Get my free Meal Planner and Grocery Savings Guide.

Utilities

The utilities budget category includes electricity, water, natural gas or propane, and trash services. Of course, these will change up based on where you live and how many people you live with!

Here are some helpful stats on what the average “consumer units” (which basically means “households”) spend:4

- $447 a year (about $37 a month) on natural gas

- $1,551 a year (about $129 a month) on electricity

- $695 a year (about $58 a month) on water and other public services

Pro tip: Learn how to save money on your electric bill.

Housing

Okay, here’s another time I’ve got an exact percent for you. Housing (or shelter) should be no more than 25% of your take-home pay. This includes your rent or mortgage payments—plus tax, insurance, HOA fees and private mortgage insurance.

So, when you’re crunching numbers to see if you can afford that lavish apartment complex with a pool, pet spa and playground—remember 25%.

When you’re plugging totals in the Mortgage Calculator to see if the neighborhood of your dreams would actually become the monthly payment of your nightmares—remember 25%.

When it comes to knowing how much house you can afford, be wise! Spending more than 25% a month on your housing can make the rest of your budget percentages way too tight—and that can turn what’s meant to be one of your greatest blessings (your home) into a financial burden. I don’t want that for you. And honestly, you don’t either!

P.S. This percentage will change when you’re on Baby Step 6, which is all about paying off that home early. And just imagine life after that! When you’re mortgage-free, you won’t have to worry about putting 25% of your income toward housing anymore! All that money can go to living (and giving) like no one else.

Pro tip: Learn how to save on home expenses.

Transportation

Gasoline, car tag renewals, oil changes—it all adds up. This category also varies depending on where you live, plus your commute to and from work, what you drive, and if you use public transportation. On average, though, American households in 2021 spent:5

- $2,148 on gasoline, other fuels and oil ($179 a month)

- $452 on other forms of transportation (nearly $38 a month)

- $975 on maintenance and repairs (about $81 a month)

Pro tip: Learn how to save money on gas.

Health

This category is an excellent example of how percentages can change from month to month or year to year.

If it’s time to get your teeth cleaned or your kid busts their chin and needs stiches in the ER, you’ll spend more on your health that month than the next. If your kid needs braces, that’s a couple years of higher health expenses. (But a great investment for their future!)

Just so you know, on average, American households in 2021 spent $1,070 total (about $89 a month) on medical services and $498 ($41.50 a month) on medicine.6

Pro tip: Save money on things your health insurance doesn’t cover.

Insurance

Okay. I know insurance isn’t fun to talk about or spend money on. But you’ve got to have it. No matter where you are with your money goals or Baby Steps, these four types of insurance are essential: health, home, auto and term life.

I also recommend identity theft protection, long-term disability insurance, umbrella/liability insurance (if you’ve got a net worth of at least half a million dollars), and long-term care insurance (if you’re 60+).

All of these vary based on, well, a ton of different things like your age, previous health concerns, the kind of car you drive, your personal driving history, the size and location of your home, your assets . . . and the list goes on and on.

The best thing you can do here? Take our Coverage Checkup. You’ll find out if you’ve got the coverage you need—and not more. (Yeah, I know it sounds crazy, but some people are actually overpaying and overcovering! No, thank you!)

You’ll also get an action plan for any insurance you’re missing. It’s quick, simple, and takes the guesswork out of knowing if you’re properly covered.

Childcare

Kids are expensive, you guys! I know, times three. (Though all three are totally worth it.)

With childcare, I’m talking about making a budget category to cover any expenses needed for parents to work—not the extra babysitting money for date nights. (That can go under the entertainment category, which I’ll talk about next!)

The average cost of childcare ranges from $10,700 to $29,800 a year per child (about $892 to $2,483 per month).7 Of course, this varies based on where you live, the kind of childcare you pick, and how many kids you have!

Pro tip: Learn more on how to budget for childcare.

Lifestyle or Entertainment

If you want to buy tickets to see your favorite boy band perform with the local symphony (which totally happens here in Nashville), you’ll need a lifestyle (or entertainment) category. The average American household spends $3,568 a year here—which is about $297 a month.8

But let’s be honest for a minute: If you’re in debt or living paycheck to paycheck with nothing in savings—cut out this budget category until you’ve got financial security. I mean it. Yeah, it’s a challenge to say no to things for a season, but it’s just a season. It’s worth the sacrifice now to get you to a better place with your money in the future!

Personal Spending Money

How much you budget for personal money each month depends on your income and Baby Step. If you’re saving up an emergency fund or paying off debt, make sure your fun money is low enough to help you get to your goals quickly. But give yourself (and your spouse, if you’re married) at least something to spend on whatever you want each month.

Looking back at those national averages, American households spend $771 a year (about $64 a month) on things labeled as “personal care products and services” and $1,754 (about $146 a month) on “apparel and services.”9

And here’s a quick callout on budgeting for clothes: If you need stuff for growing kids who don’t fit in their things anymore, that’s different than wanting this season’s latest and greatest because you love fashion. Clothes for the love of clothes are a want, not a need. Stick that under personal spending, and don’t sacrifice your needs or other money goals for the fun stuff.

Miscellaneous

It’s hard to plan for everything and still make a zero-based budget—unless you create a miscellaneous category for about 5% of your take-home pay.

This is for the things that pop up in a month but aren’t actual emergencies—like your kid getting a last-minute invite to a friend’s birthday party. With a miscellaneous category, you can grab a gift without derailing your budget.

The miscellaneous category is also great for those times you underestimate how much you’ll need for a certain expense. Let’s say you get the water bill, and it’s a little more than expected. It happens! Don’t panic. Just move some money from the miscellaneous category to the utilities category. Problem solved.

If you don’t end up spending anything from your miscellaneous category, give yourself some high fives. (Okay, so that’s mostly just clapping, but that works too.) Then put all that extra cash toward your current Baby Step!

Debt

If you’ve got debt, it’s time to cut out extras, lower your spending, and find ways to up your income. All the extra money you add to the budget from doing these things should go to paying off your debt.

Notice I didn’t give you a set percent here—I’m saying throw everything you can at this super important money goal.

Because the thing is, debt robs this month’s income to pay off the past. You can’t get ahead when you’re constantly paying for the past. So, free up your paycheck (all of it) by getting debt out of your life. ASAP.

Pro tip: Use the debt snowball method to pay off your debt. Fast.

How Do I Determine the Right Budget Percentages?

So, good budgeting isn’t about sticking yourself inside a budget percentage box with everyone else in the whole entire budgeting world. That doesn’t work.

If you want to make a budget that does work (for you—in your stage of life, with your income, Baby Step and money goals in mind), my best piece of advice is simply this: Start budgeting.

And my personal favorite way to do that is with our free budgeting tool, EveryDollar. EveryDollar is the app my family uses for our monthly budgets, and I love how simple it makes things.

The truth is, it doesn’t matter if you’ve budgeted never or a million times—you can do it with confidence. Starting right now. Think about the numbers I just shared, look at your own numbers, download EveryDollar, and get your money working as hard as you do.

Save more. Spend better. Budget confidently.

Get EveryDollar: the free app that makes creating—and keeping—a budget simple. (Yes, please.)