Given the choice, most of us would probably prefer watching paint dry over the idea of reading our credit card statements line by line when they arrive in the mail (or our inbox).

Let’s face it: Scouring our credit card statements isn’t usually the first thing we want to do in our free time. But it’s actually worth your time, because skipping over that fine print can cost you actual dollars and cents—and a lot of them—if you're not careful.

That's why we put together a handy cheat sheet to help you understand just what all of those scary-looking financial terms mean and how they might end up impacting your account balance. Go on—pull out your latest credit card statement, and let’s dive in:

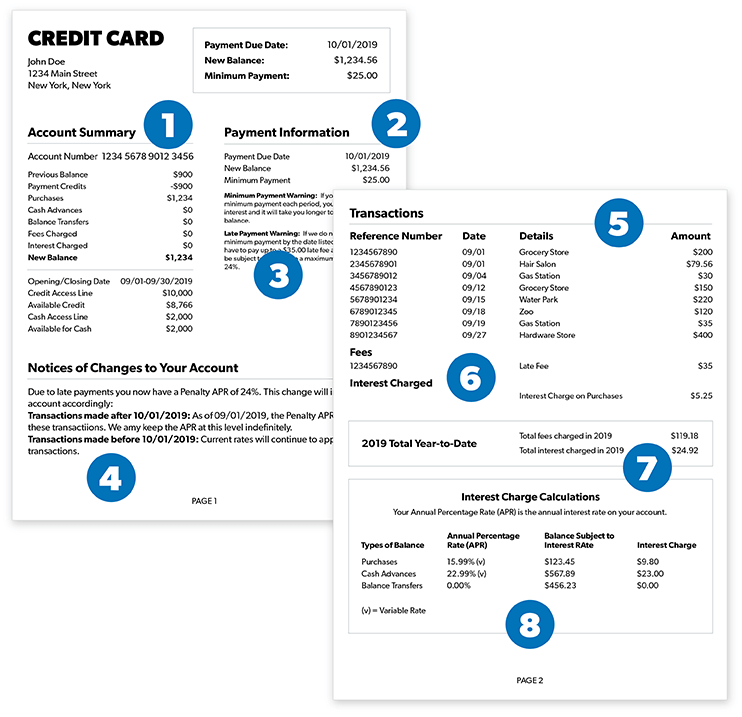

1. Account Summary

The first thing you’ll probably lay your eyes on is the account summary—it’s at the top of your statement. The account summary is a nice, clean rundown of all the transactions made on your account during the previous billing cycle. Typical, run-of-the-mill transactions will include things like payments, credits, purchases, balance transfers, interest charged, cash advances, fees and any amounts that might be past due (no judgement here).

Once everything has been added up, your statement will show a new monthly balance (that’s how much you spent). You’ll also see your available credit (that’s how much you have left to spend). If you charged anything in the past month on your card, that number will be lower than it was on your previous statement.

Lastly, you’ll see your due date—the date you need to pay up before bad things start to happen, things like interest rates and fees beginning to climb on your balance. And nobody wants that!

2. Payment Information

Up next is your payment information, which will include a restatement of your new monthly balance, along with your minimum payment amount. This is the lowest dollar amount you need to pay by your statement's due date in order to avoid penalties (like interest rates and added fees). Compared to your account balance, this number will seem extremely low, sometimes representing just 3% of your total account balance or a mere $25.1

Listen closely: You can avoid interest and fees by paying more than your minimum balance every single time. You can also avoid them altogether by saying goodbye to your credit card for good. But more on that later . . .

A payment is only considered to be on time if it's received by 5:00 p.m. on the listed due date. Anything received later than that will be considered late. And if you’re late on your payment, you can say hello to that late fee and goodbye to that money you were going to use for your afternoon latte.

3. Late and Minimum Payment Warnings

Now let’s talk about everyone’s favorite section—the late and minimum payment warning section. According to the CARD Act of 2009, both late and minimum payment warnings must be issued on all credit card statements.2 This means that credit card companies and banks must clearly state what penalties will occur if you don’t meet the minimum payment or even miss the due date completely (at least they’re being nice about it).

Not only will this warning tell you how many Lincolns may be tacked on to your next bill, but it will also let you know that your annual percentage rate (APR) may go up as a result of late or inadequate payments.

4. Account Changes

Looking for changes to your interest rate or account terms? Look no further. This section will detail them (hopefully clearly) if you have any. If you see any changes to your interest rate, the culprit might be that you’ve gone over your credit limit. But this shouldn’t ever be a surprise to you. Lenders are required to notify you if this happens.

Don’t let credit control your life! Learn the proven plan to win with money.

And don’t worry—these companies are required by law to tell you 45 days before they increase your APR or make any other significant change to your rate.3 Understanding exactly when (and how much) your rates will be changing is key so you won't be blindsided later.

5. Transactions

Remember those transactions from the account summary section we talked about earlier? In this section of your report, you’ll see them again . . . but in more detail. This time, you’ll typically see a transaction number, a transaction date, a post date, a description of the transaction or credit, and the total amount of each transaction.

If there are other users on a particular account, like a spouse or dependent, this section will tell you which user made which transaction on the account. Note: All transactions should be listed in the order they were made, from oldest to newest.

6. Interest Charged and Fees Applied

Now for the real meat and potatoes of your credit card statement. This is the section credit card companies and banks don't want you to look at too closely. Why? Because this is where they list any specific interest or fees they’re charging you, such as late fees, balance transfer fees and cash advances.

That’s right—credit card companies are basically charging you money just for using your account! This section literally shows you how much money they’re taking out of your pocket. And it's all the way down on your credit card statement for a reason. They don't want you to find it. Nope, that’s not a smudge or a shadow. That's just the fees they're trying to hide from you.

Like we’ve said before, the longer you go without looking at your credit card statement, the more interest and fees can build up. At this point, we’re guessing your blood pressure is starting to rise—and with good reason. This is a prime example of why the credit card industry is so large. They make money simply because they’re expecting people to be too busy to pay close attention to their credit card statement each month.

7. Year-to-Date Totals

In this section, you're going to see things totaled out since the beginning of the calendar year. Sure, it’s pretty straightforward, but you're going to notice two things in particular: total fees and total interest. Once the year resets, this section will too.

When it comes to annual calculations, there shouldn’t be many surprises—although this is another opportunity to see just how much money you've been paying back over the course of the year. Fair warning: If you look closely enough at this number, you might get so angry that you decide to use the debt snowball to pay off the entire thing.

8. Interest Charge Calculation

And finally! All the way at the very bottom of your statement, you’ll see a summary of the various interest rates on the different types of transactions and account balances.

You might notice things like type of balance, APR, balance subject to interest rate and interest charge. This is where you'll get an up-close-and-personal look at just how much you've been dinged by unnecessary interest rates throughout the course of the year.

It might seem small at first, but imagine what happens when people don't bother to look and that number gets bigger and bigger and bigger. Pretty soon, it becomes easy to see how 78% of Americans are stuck living paycheck to paycheck.4

Credit card statements vary depending on the lender, and unfortunately, we don't have time to dig in to each one here. Just know that sometimes you’ll also see other sections like your FICO credit score, rewards or cash-back bonuses, credit counseling notices, payment coupons and more.

But instead of dreading that credit card statement landing on your front doorstep each month and sifting through a mess of financial terms, stop relying on credit cards altogether.

You can learn how with Financial Peace University. This course teaches you how to take control of your finances, save for emergencies, budget your best, pay off your debt—and live your life credit-card free. Yup, all that in nine lessons. Get started today.